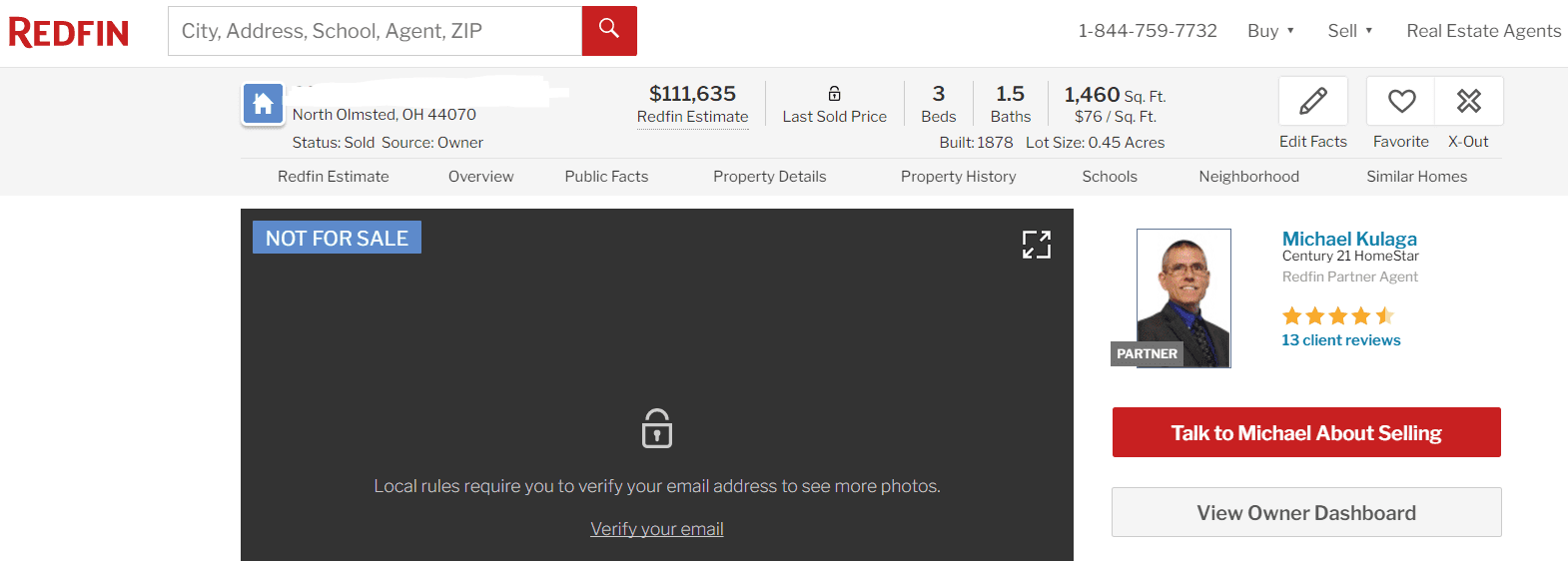

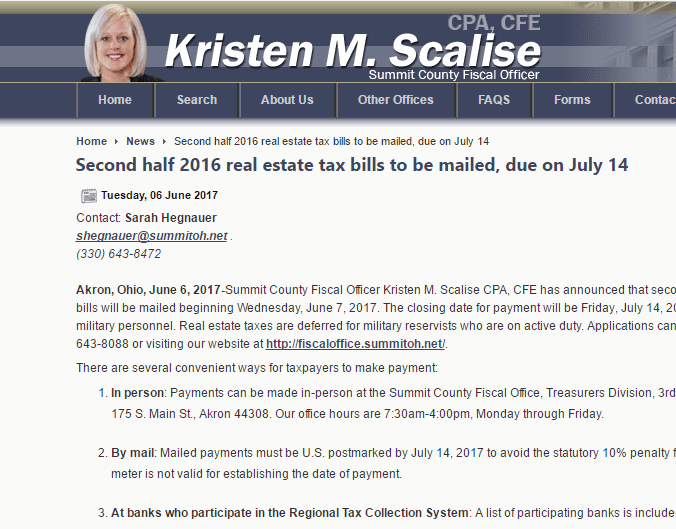

Property values are on the rise. It didn’t take long for interest rates, gas prices, the cost of food and household goods to follow. What’s next on the rise? The divorce rates in Ohio. A recent article, “Divorce Filings rise

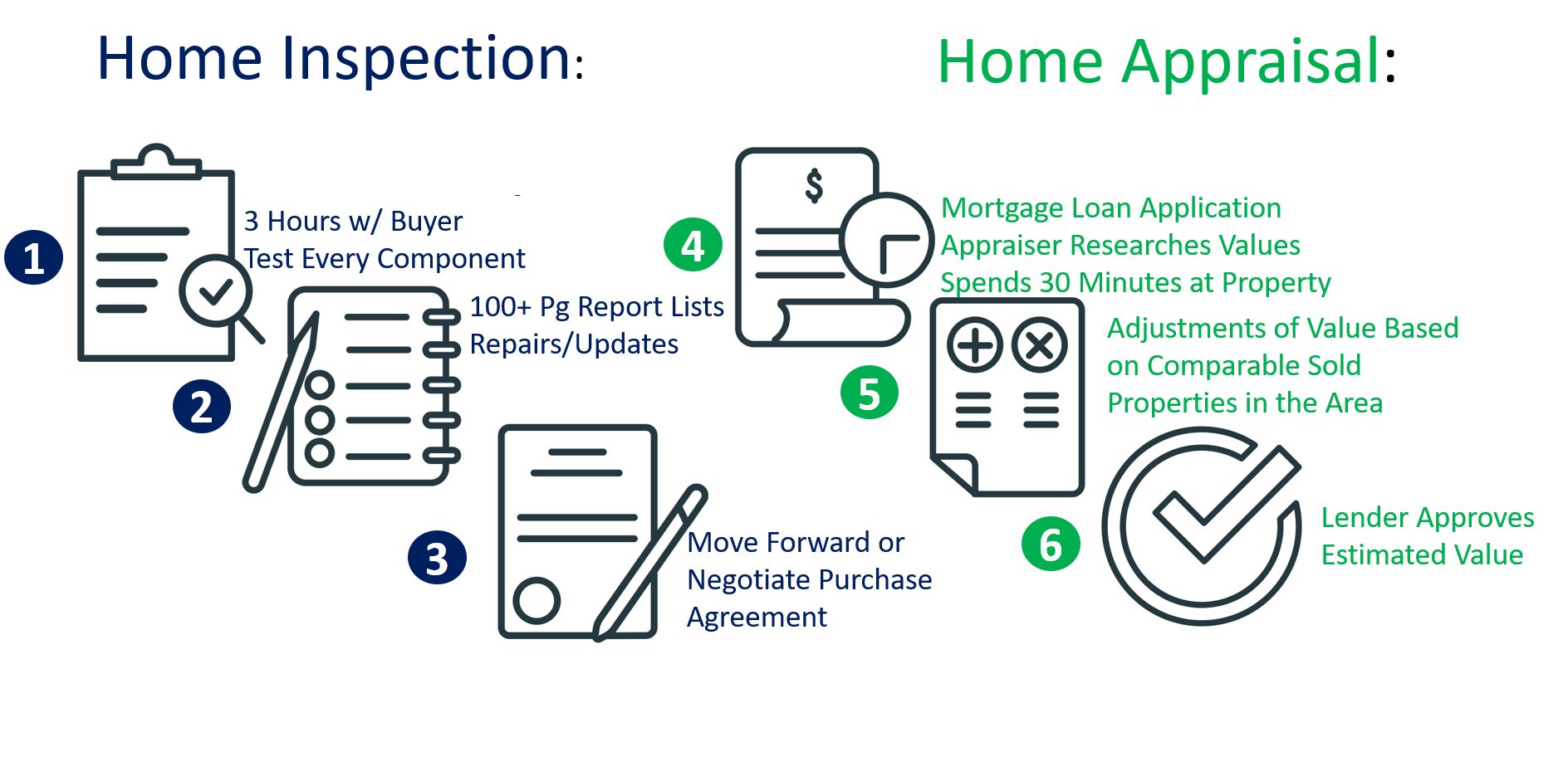

Getting a Fair Appraisal for Your Divorce