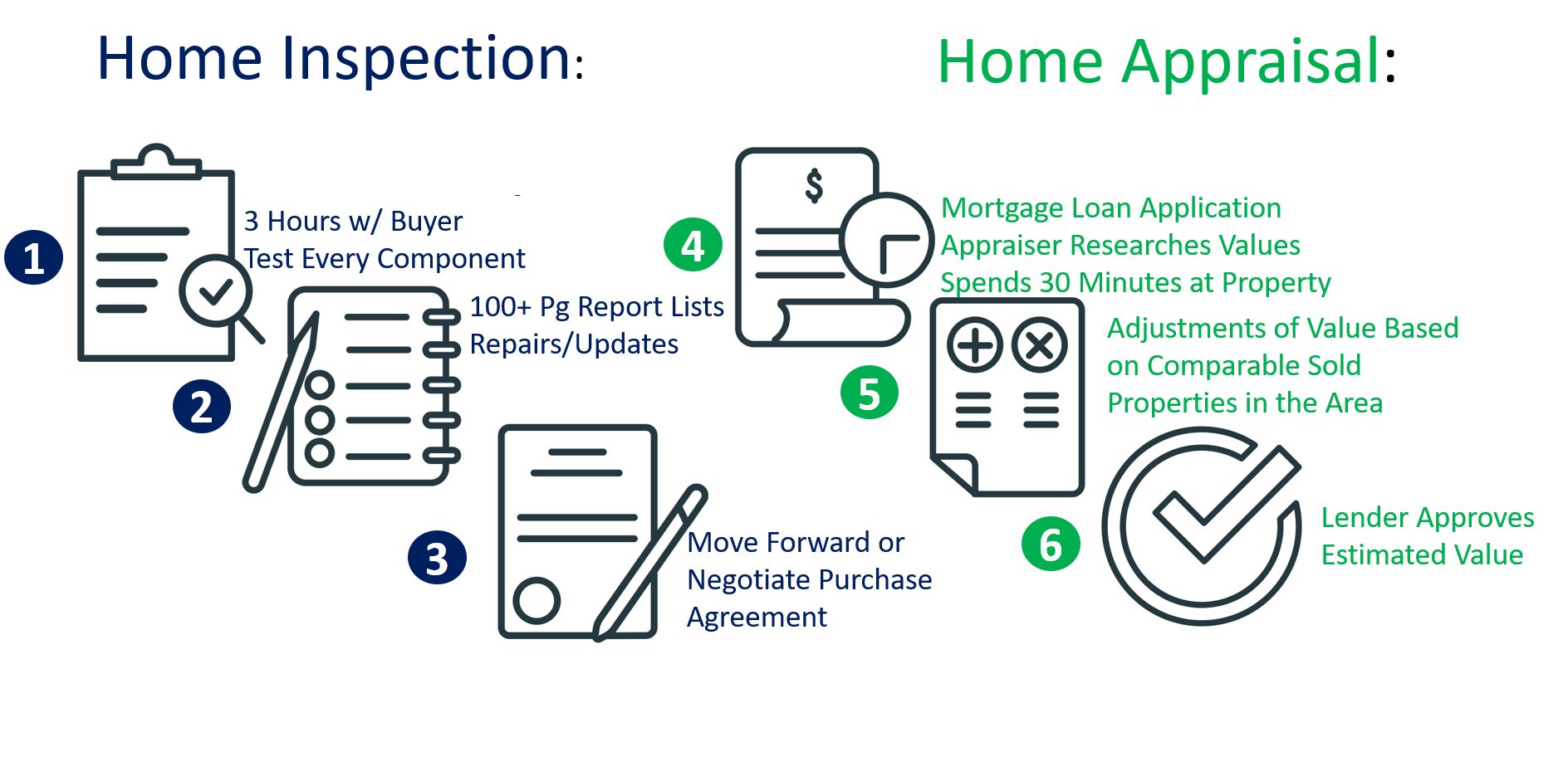

A lot of people think the home appraisal and a home inspection are the same. But that is not the case. The simplest way to remember the difference is to think: The home inspection is for the buyer. The home

I Have a Home Inspection Report, Why Do I Need an Appraisal?