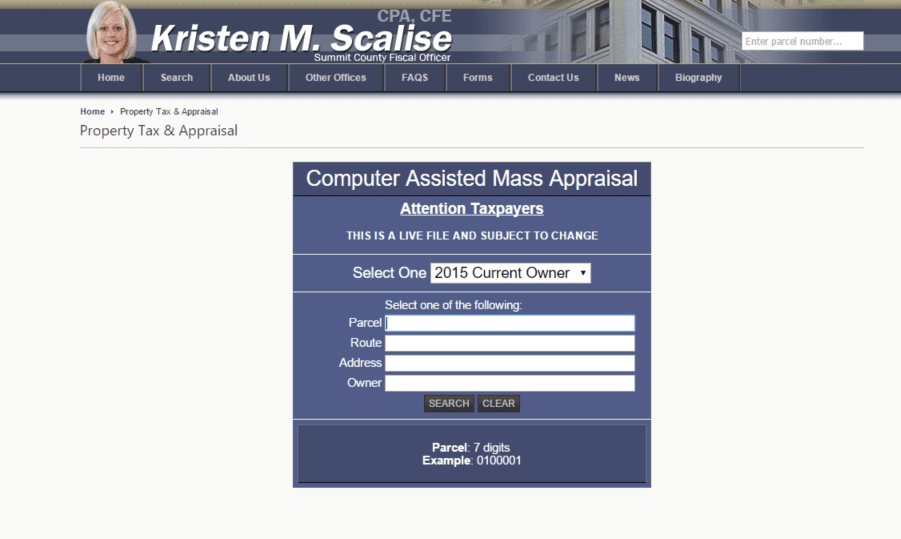

In Summit County Ohio, the county including Akron, Fairlawn, Hudson, Twinsburg, Stow, Cuyahoga Falls and others, there are approximately 270,000 taxable parcels of land.There are two major factors that influence the amount of real estate taxes a Summit County property owner

Appealing Your Summit County, Ohio Property Tax Values