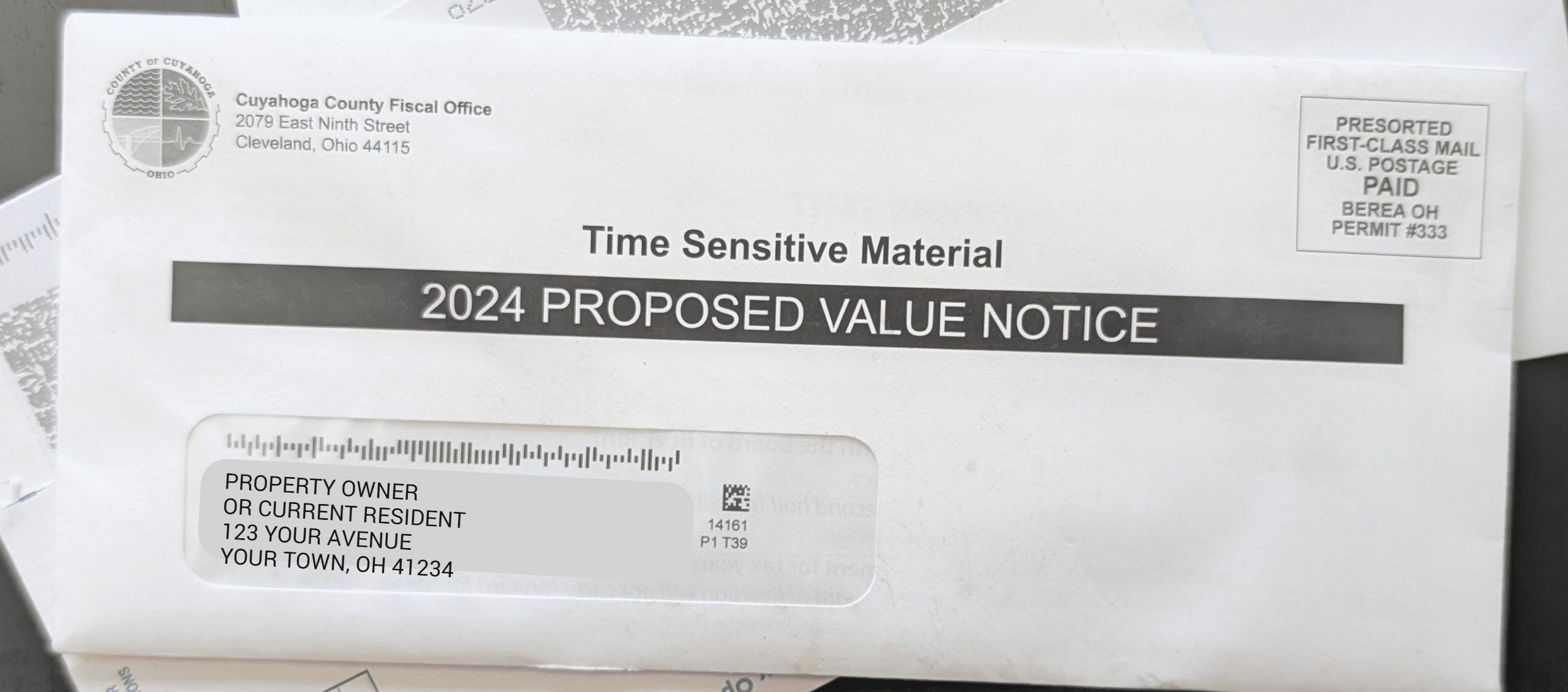

Have you recently received an assessed value of your property from the county that you feel is unfair or inaccurate? How do you contest your property's value? The form on this page is the first step to ordering an appraisal used in appealing your tax assessment. You will not be asked for payment or scheduled for an appraisal until our team reviews the inquiry and discusses your situation in order to determine if a tax appeal appraisal may be beneficial. Please fill out the form on this page as thoroughly as possible to let our team understand more about your tax appeal situation.

Contesting Cuyahoga County Property Value: Filing A Real Property Appeal

At Fast Appraisals our team of certified residential appraisers provide appraisals for properties throughout Cuyahoga, Lorain, Lake, Medina, Summit, Portage, Geauga and Ashtabula that can be used to contest the county's property value. Each county has their own process for contesting tax assessed property valuation which can be found on our tax appeal appraisal page.

In Cuyahoga county, without evidence of a recent sale of the subject property, a party should be prepared to submit a formal written appraisal of the subject property. The appraisal must meet the following requirements:

- Prepared by a qualified appraiser who must also testify before the Board of Revisions (BOR) or Board of Tax Appeals (BTA)

- Performed for tax valuation purposes, and

- Reflecting an opinion of value “as of” the tax lien date, i.e. January 1st of the year challenged

For more information about filing a real property tax appeal in Cuyahoga County read our page Property Tax Assessment: How to Challenge the Value & File an Appeal or visit the Cuyahoga County Board of Revisions site on Important Information about Filing from Board of Tax Appeals.

Order a Tax Appeal Appraisal

We have updated our tax appeal appraisal order form in order to save time in email and phone communication while we help you determine if spending money on a tax appeal appraisal is a wise decision. Each property tells a different story and the appraisal team at Fast Appraisals has decades of experience with the Board of Tax Appeals telling that story. Help us understand your situation to determine if a tax appeal appraisal would make sense for your situation: