(updated content for disputing tax valuation from Cuyahoga County in 2021): Letter From Owner and Lead Appraiser We have been answering calls non-stop regarding the Cuyahoga and Lake counties tax re-assessments so thank you for your patience for those of

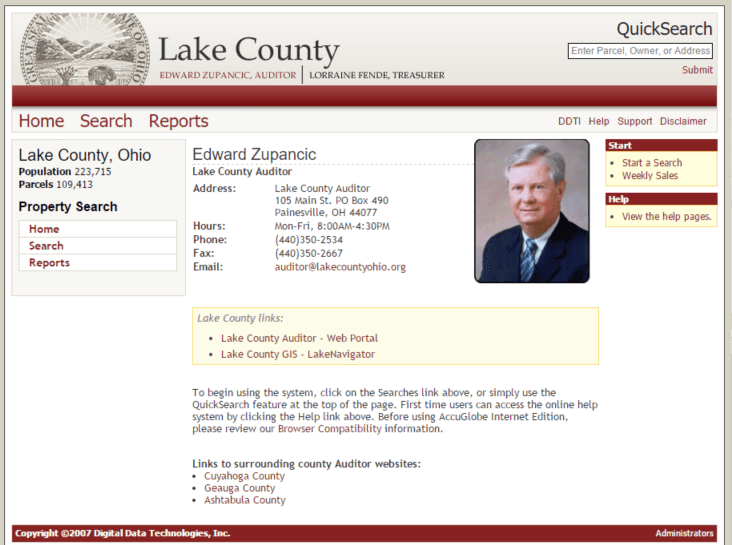

Cuyahoga & Lake County 6 Year Reappraisal