Over the years Fast Appraisals, a Cleveland home appraisals company, has been performing a steady increase in bankruptcy appraisals, or a residential property appraisal to determine the valuation of residential real estate when filing a bankruptcy. Many home owners that

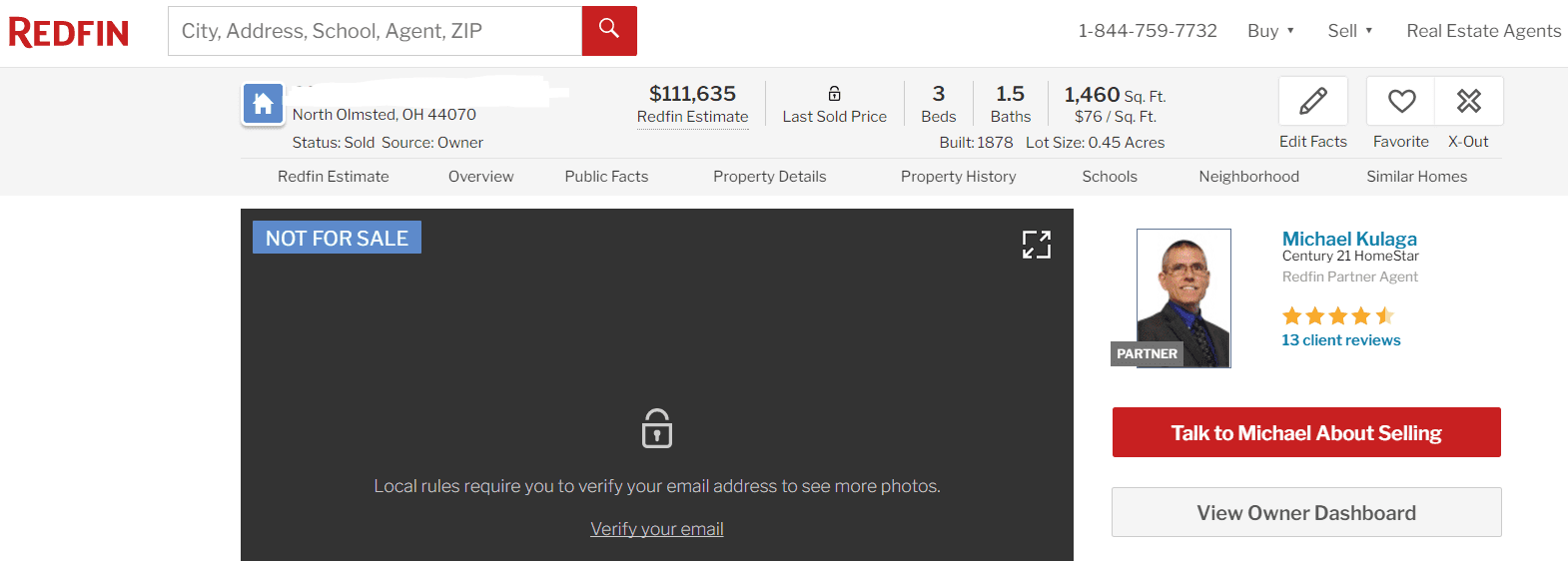

Bankruptcy Appraisals: Certified Home Appraisal vs. Realtor Valuation or Zillow