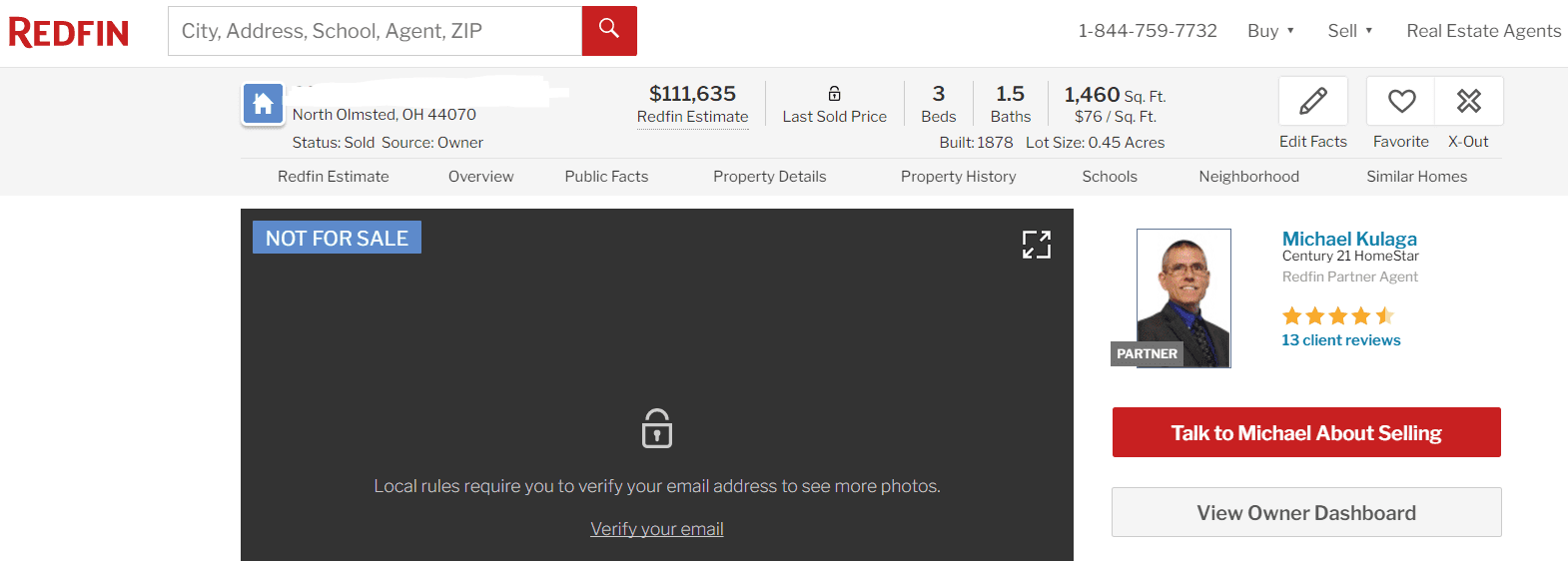

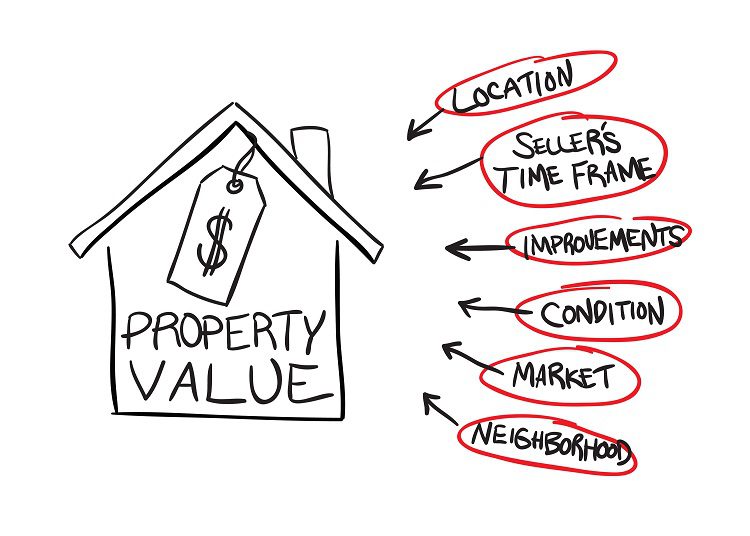

Summit County Property Appraisal; Values Rising Are you seeing a recent increase in news articles mentioning the rise of property values near you? Do you hear talk of how people in the area need home appraisals to find the value

Summit County Property Appraisal: Rising Prices, Why You Need Home Appraisal