In the state of Ohio county auditors are responsible for assessing the market value of each land parcel to determine the amount at which the owner is charged a property tax. As any home owner knows it’s this revenue that

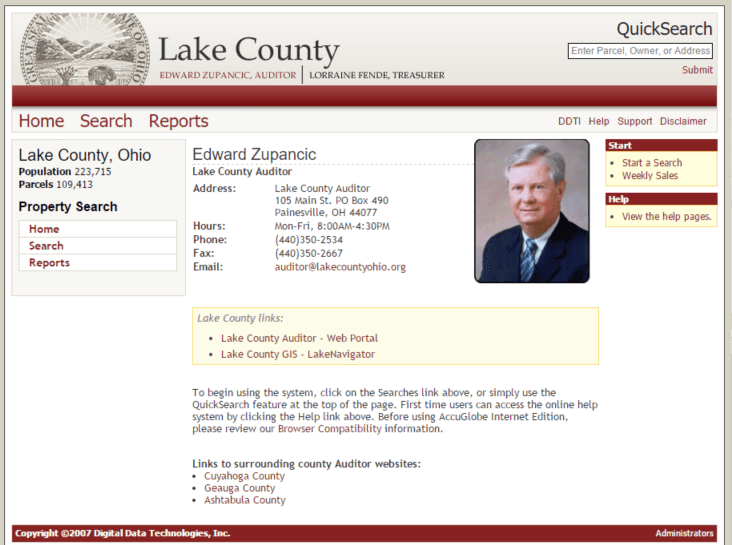

Lake County: Appealing Your Tax Assessed Property Value