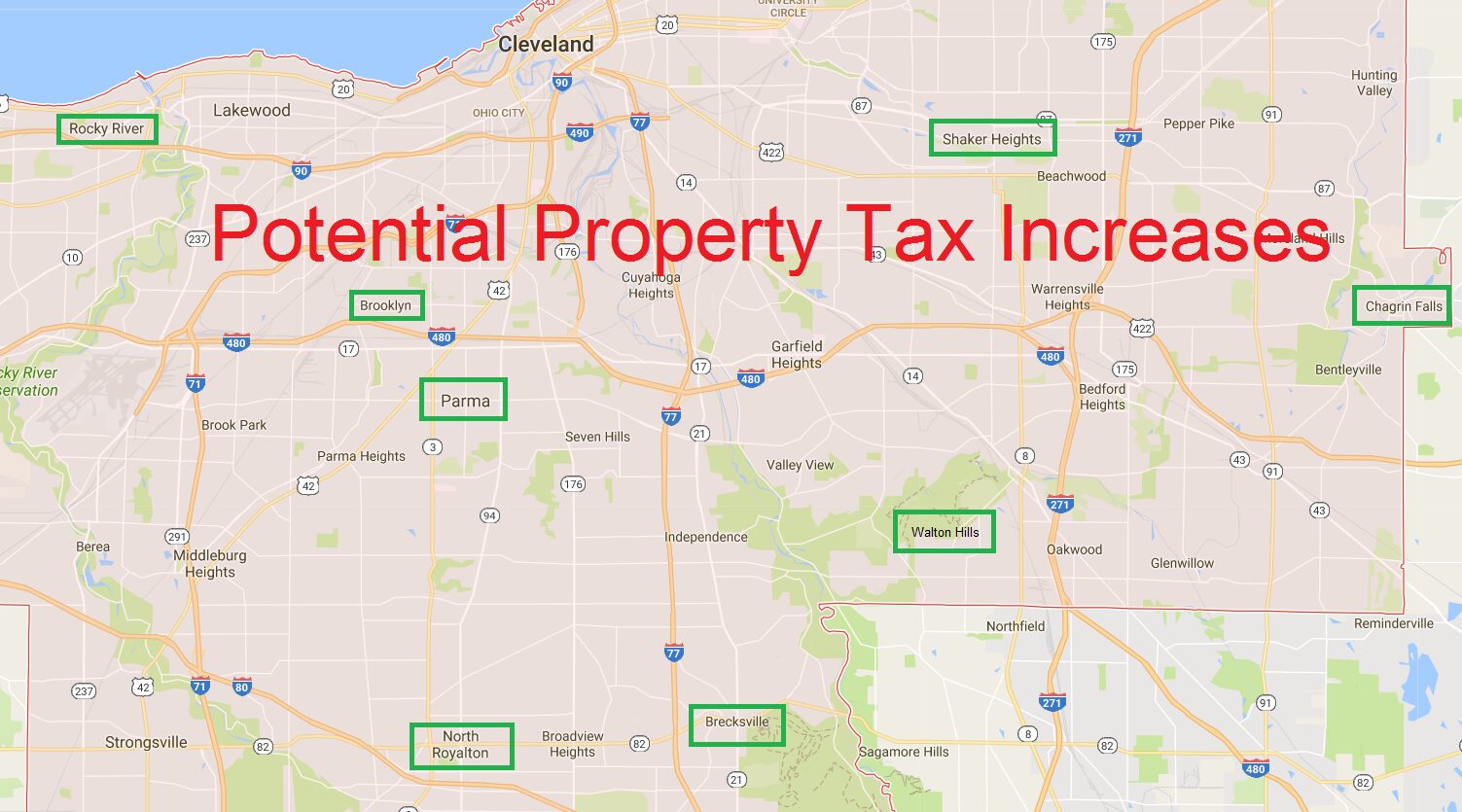

How Do You Appeal Property Taxes? A Guide to Successful Real Estate Tax Appeals As a property owner in Cuyahoga County, the triennial and sexennial reappraisal processes can bring significant changes to your real estate tax obligations. At Fast Appraisals

How to Appeal Property Taxes in Cuyahoga County, Ohio